The U.S. is facing an unprecedented housing shortage. Estimates vary, but experts agree this deficit is measured in the millions from 3 to possibly over 7 million homes impacting affordability, economic mobility, and community development.

Key Data Highlights & Insightful Stats

Magnitude of the Shortage

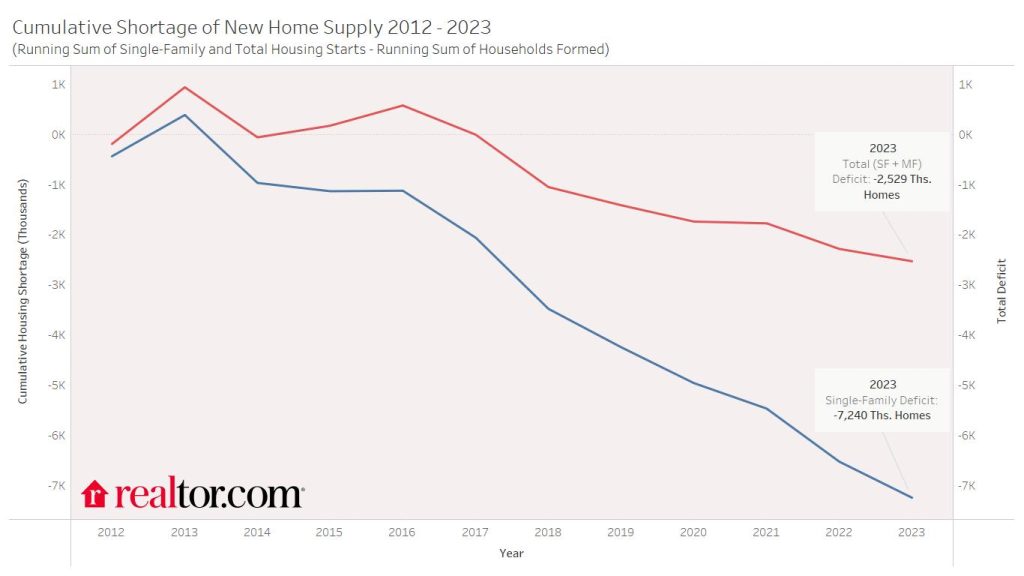

As of 2022, the U.S. was short about 3.2 million homes, roughly 2.5% of current housing inventory.

Broader analyses estimate the total shortage may range between 1.5 million to 5.5 million units in recent years, with one estimate pegging it at 4.9 million by the end of 2023.

Zillow reported the shortage grew to 4.5 million homes in 2022.

Rental vs. For-Sale Shortfall

Freddie Mac economists estimate the U.S. needs 1.5 million more vacant homes split between rentals and homes for sale—to return to balanced vacancy levels.

Affordable Rental Crisis

Across the nation, there is a dearth of affordable housing for extremely low-income renters—7.1 million units short, with only 35 affordable homes for every 100 such households.

Long-Term Underbuilding Trend

Historic data shows a decline in housing starts per 1,000 households—from 22.2 (1960–1990) down to just 12.2 through 2022.

Impact & Consequences

Affordability Crisis:

Housing shortage has driven up prices and rents—by some measures, home prices have risen ~30% since 2017.

The median income needed to afford a home surged—by 2024, it reached $126,670, while the median household income was only ~$80,610.

Social & Economic Strain:

Many low-income renters and older homeowners are severely cost-burdened, spending over 30% of their income on housing.

Regional Disparities:

Some states—like Massachusetts—are especially hard-hit; for example, an income of $210,000 may be needed to afford a median-priced home there.